Personal financial success is primarily the result of hard work and wise application of expert lessons when it comes to handling money. The success aspect is a goal many want to achieve on their path to being independent financially.

When focusing on personal financial success, several factors come into play, to act as the rungs of a ladder towards your triumph. Among the factors include discipline, versatility, inquisitiveness, and many more.

Why Is Financial Success Important?

Your financial success is critical as it signifies the achievement of your goal in the management of your finances. The main point in such a triumph is the financial liberty that cones where you are able to make your money decisions without feeling stretched. You also have the assurance of pulling yourself out of the mud in the face of emergencies, which become common as you grow.

How Do I Achieve Personal Financial Success?

The above question is the right step forward to a personal financial success story. To craft your success story below is a five-step approach to bank on as you focus on the bearing that is monetary control ascendancy.

1. Identify Your Current Financial Standing

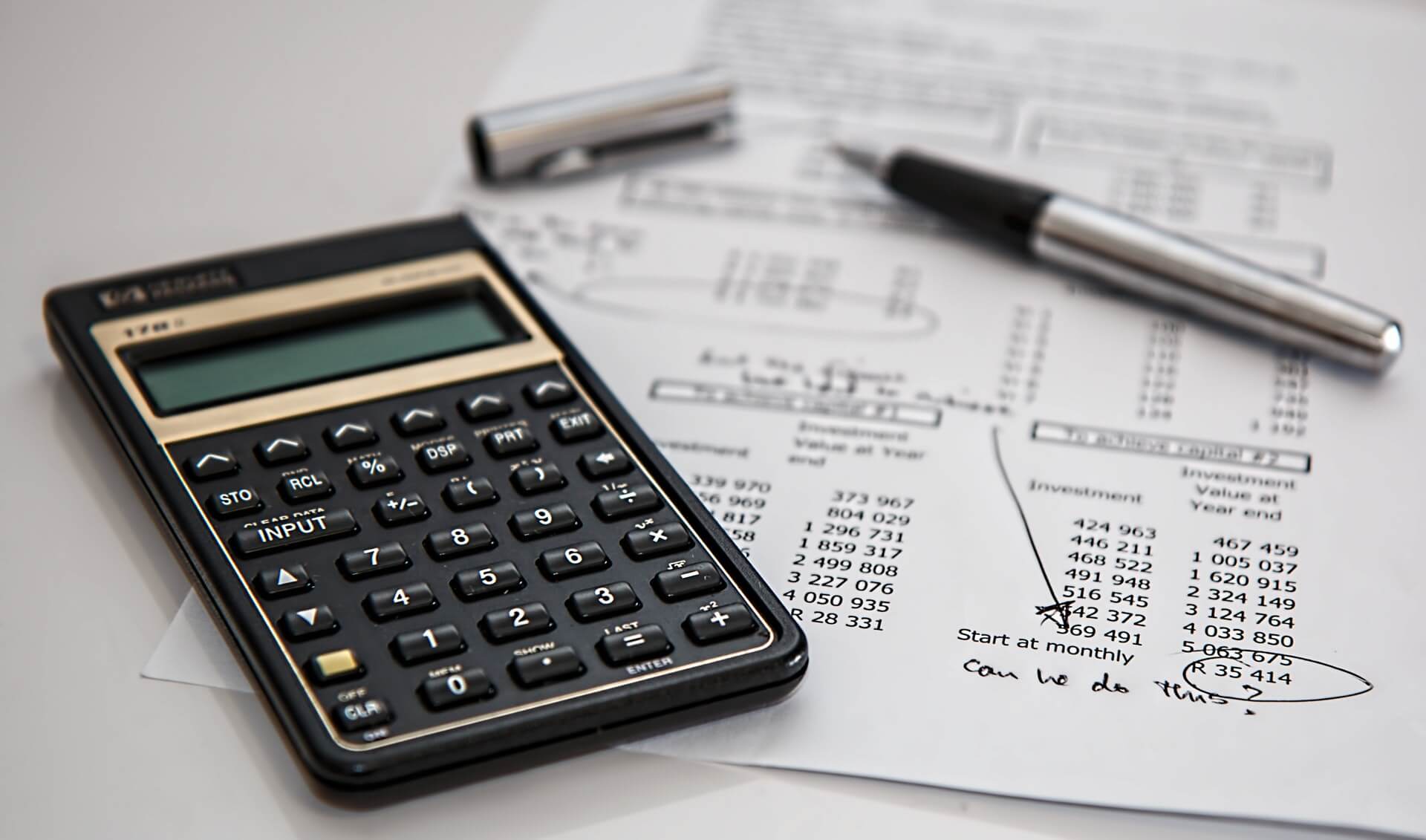

Identifying your present financial position is one of the essential keys to personal financial success, that many people overlook. It is the personal consultation stage that helps you point out your flaws and strengths when it comes to the control and use of your money.

While on this step, take notes of important things such as your purported net worth, your earnings, and the frequency at which you get money. Do not forget to look at your expenditure as it gives you a clear picture of how you spend your money, hence promotes the value of accountability.

Once you have a clear picture of your monetary standing, bring your goals into the equation. Success is a relative attribute and varies from one person to another. Here is where your goals need to fit into your definition of success. It may be investment, acquisition of assets, or even accumulation of money.

Be realistic with your goals, and make sure there is a touch of congruence when looking at your current financial position and lifestyle.

2. Come Up With a Stable Plan

An essential personal financial success step that should follow is coming up with a plan. Many financial success quotes point to planning as an essential step to meeting your goals in ample monetary control. The plan provides a concrete bearing on where to head to get you closer to your target with every move you make.

When coming up with a scheme, try and have it in stages for more straightforward implementation. For example, if you want to invest, start with a savings plan to raise money for your capital. Even with the savings, start it step by step as you increase the allocation gradually.

In financial planning, budgeting is most of the time an area of focus. Budgeting is an important area to look at and forms the foundation for other plans you have. Put down a budget and get a clear view of your expenditure.

When budgeting, it is advisable always to have savings included in the plot. Take a page from the book of the 50 30 20 rule (that we discuss below).

What Is The 50 30 20 Rule?

Evident in several books of financial success, the 50 30 20 rule looks at allocation fractions when coming up with a budget for your income. Using this rule after taxes, you allocate 50% of your income to cater for essential needs such as food and shelter. The 30% goes toward your wants, where you look at entertainment and luxury. The remaining 20% goes to your financial wellbeing, be it savings, investments, clearance of debts and loans, or insurance.

It is an excellent rule to follow and comes in handy during budgeting.

3. Implement Your Plan On Savings And Investments

Planning without implementation remains to be a wish. To make your financial success stories count, you need to get down and implement the set schemes. Among the essential aspects of a financial success plot, is savings and investments. The two are sure to have your back and guarantee your economic security even on rainy days.

Following the earlier hinted approach, the 50/30/20 rule, allocate a decent amount of your income to savings and investments when crafting your budget. Savings is an important facet, and most of the time, it is the foundation for investments when you do not have sufficient funds to lift your startup from the ground.

Your set-aside funds also come in handy during hard days to offer you the figurative shelter. In its sense, it is a form of financial security that you need always to have stashed safely.

Investments are also savings only that the injected figure has a projection of appreciation if things work per the plan.

What Not To Miss When Saving And Investing

When you set your mind on savings and investments, one of the virtues you need to have is discipline. It guides you on getting a proper schedule of making the right allocations and never touching the funds you set aside unless in dire situations.

When investing, look for a solid investment idea that guarantees you handsome returns. In this situation, you need to get to the ground and conduct some research on the best paths to follow for decent returns.

4. Seek To Expand

There are several tips to help you succeed financially, and a significant number of them will point to the expansion of your ideas as you invest and save. One thing you have to avoid when aiming at personal financial success is stagnation. Being stagnant translates to comfort and contentment. Doing this is not advisable as you never will achieve any goal by doing nothing.

The expansion means growth, and growth in the economic essence points to improved earnings – a critical marker for financial dominance. One way to get on the path of expansion is to seek financial literacy.

To boost your financial knowledge, attend classes on financial matters. If you lack time to attend classes, find financial advice books several books. There are plenty of books touching on financial success stories and tidbits to motivate you on your path to success. There are also meetups such as conferences and seminars, which you may sign up to. Such workshops discuss a lot of topics touching on finance such as discipline, trends, and also worthy investment ideas to look at.

Not just that. Thanks to technology, you can access articles like this one and interact with others like you on online forums.

With comprehensive knowledge, you are able to go head-on in crafting your way to economic success. Real-life experiences also add to what you know. Take failure in whatever you do as a lesson.

5. Analyse, Revise, and Correct

The preceding steps may work or fail, depending on your approach and other factors you have no control over. Regardless of the outcome, this step is vital to know what you did right or where you messed up. Replicate the same formula and ideas that have worked so far to achieve broader monetary goals in the future.

If you messed up, you get to know where you went wrong and have a chance to redo the whole process, being keen on mistakes in subsequent trials. Also, by analyzing your goals, you are sure if you met your target or fell short despite flourishing investments.

Not To Forget

As you seek your financial freedom, there is one facet you may ignore – loans and debts. They are crucial and may come to your aid during difficult times. However, before banking on credits, you need to learn to take them when you have urgency.

If it is not urgent, avoid it. The same goes if you deem yourself not disciplined on financial matters. Here, you avoid getting into bad debt, which can be a massive obstacle towards your pecuniary independence. When taking a loan, read all terms carefully, focusing on the period and interest to be sure it fits into your repayment plans. You don’t have to sign the dotted line only to realize the lender has hidden costs you’ll incur.

Move Towards Financial Success Now

The steps above will help you to craft a financial success story if you employ them right. By the end of the day, you are sure of excellent results that impact your net worth. Begin by realizing your current financial situation, have a plan, implement the plan, expand your operations, and correct the areas you fail.

Always budget wisely, living ample space for savings and investments. Guided by discipline, you are sure of a secure back in case of dire economic situations. Seek books and attend meetups to widen your financial knowledge, which is essential when trading the path to monetary dominance. You are capable of having growing your financial capacity more than you think. Go for it!